Golden Ocean Stock: An Interesting Investment Opportunity (NASDAQ:GOGL)

Written by ABC Audio ALL RIGHTS RESERVED on July 10, 2022

welcomeinside

During the last year and a half, I have written many articles regarding dry bulk shipping companies, especially about Star Bulk Carriers (SBLK) and Diana Shipping (DSX). So far, I hadn’t written anything on another dry bulk industry behemoth, Golden Ocean Group Ltd (NASDAQ:GOGL), which is something that even myself can’t explain. Today, I will be taking a look into this company and specifically into its fleet, time charter equivalent rates, dividend and profitability and summarizing why I consider it an interesting investment opportunity in the dry bulk market.

GOGL’s X-Ray

In their Q1 2022 earnings release, the company reported net income of $0.62 per diluted share. From this figure, Golden Ocean distributed $0.50 per share as a quarterly dividend, which stands for an 80% dividend payout rate. Despite the 44% cut in the dividend, forward dividend yield still stands on a nice and hefty 19%. Additionally, during the first quarter of this year, the company achieved a time charter equivalent rate of $24.3k per day, down by 30% compared to Q4 2021 TCE of $35k. While this difference was partially attributed to the absence of proceeds related to the sale of used vessels, the main reason behind it was the traditionally weak first quarter of each year in the dry bulk market.

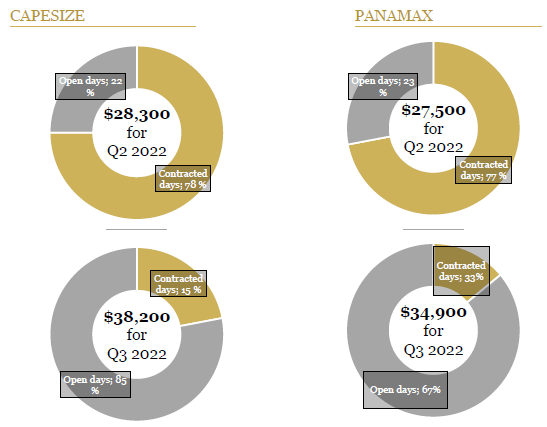

So, in a heavily seasonal market, it is usual for second quarters to be stronger than first ones, in terms of time charter equivalent rate. In the company’s Q1 2022 earnings presentation, it is stated that the company had secured a TCE rate of $28.3k per day for 78% of the Q2 2022 Capesize days, and $27.5k per day for 77% of Panamax days of the same quarter.

Capesize and Panamax booked days in Q2 and Q3 2022 (Golden Ocean Group Ltd. Q1 2022 Earnings Presentation)

As we can see in the graph presented above, the rates are even higher as we move into the third quarter of 2022, although in general, all real rates will be lower due to ballast off days.

This information, however, raises two questions:

- To what extent will these rates affect the overall TCE rate of Q2 2022?

- Are the Q2 and Q3 2022 rates, for the non – contracted vessels, still up to date?

I’m going to try to answer the first question by taking a look at the company’s fleet and the percentage of it being time chartered. Golden Ocean Group, as I write this article, has a total of 94 vessels, 91 of which are Capesizes or Panamaxes. So, this is really helpful in trying to reach to a guesstimate of its achieved TCE in Q2 2022. From an exclusively vessel type standpoint, it would be rather safe to assume that the rates indicated in the graph listed earlier won’t be affected by other vessel types.

We’re now free to move to the next section of my answer, which involves the percentage of the vessels being deployed in the spot market versus those that are time chartered. In the company’s website, we can see that 9 vessels are operating under a time charter contract, which stands for just less than 10% of the company’s total fleet.

So, this leads us to the last section of my answer, which is the current time charter and spot market rates. Yesterday, the Baltic Dry Index closed marginally down by 0.3%. However, the index tracking the Capesize rates, the BACI, rose by 3%, which is translated to a daily rate of $18.8k. In addition, the Panamax index lost another 2.4%, with rates landing at $20k per day.

Now that we have the complete picture available, we can see that these rates are far off the ones mentioned in the graph listed earlier. But what does that really mean for shareholders? In my opinion, it means two things:

- Q2 2022 will be not so strong as the management would have expected, but still very much adequate to support the current distribution level. In fact, the company’s management has said multiple times that they don’t intend to sit on a large pile of cash, but rather distribute them to their shareholders. That being said, don’t exclude the possibility of a pleasant surprise in Q2 2022 TCE rate, as the management historically has been opportunistically exploiting long term time charter opportunities when they find them.

- Q3 2022, which represents the start of the seasonal upswing, will be much lower than indicated in the company’s Q1 earnings presentation. That doesn’t mean, however, that the company won’t be able to achieve some nice profitability. With low debt, no scheduled CapEx and very low breakeven rate, I think they will manage things just fine. And the reason I’m saying that is because traditionally, fourth quarters are the strongest in the dry bulk markets and because the current slump in shipping rates is exaggerated. Despite the obvious reason of the slowdown of the global economy, there are factors such as the very low order book, slow steaming, state capital expenditures to fight stagflation, higher number of tonne – miles due to geopolitical reasons etc. that are supporting the dry bulk market and will continue to do so as we move forward.

Bottom Line

Golden Ocean Group can easily enter by hall of fame of dry bulk shippers, together with Star Bulk Carriers and Diana Shipping. The company offers an out-of-this-earth dividend yield, which is sustainable at least for another quarter, while its management has been enhancing shareholder returns by securing long term time charter contracts in favorable rates. Due to the almost exclusive exposure in larger vessels, however, its price action and profitability could be more volatile than some investors would opt for. However, it seems that this volatility won’t be enough to affect the overall profitability of the company.