AT&T: Benefit From An Investment Despite Stagnant Prospects

Written by ABC Audio ALL RIGHTS RESERVED on August 5, 2022

Justin Sullivan

Investment Thesis

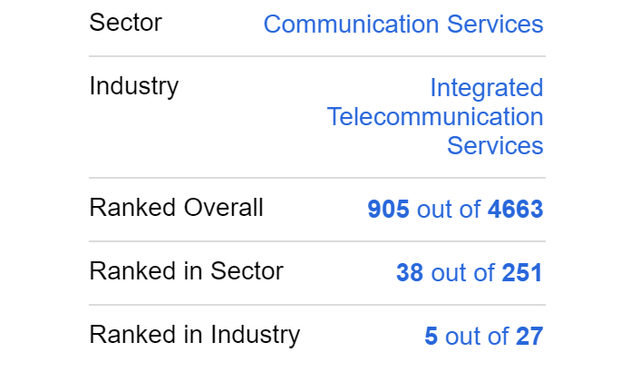

- The Seeking Alpha Quant Ranking shows strong numbers for AT&T (NYSE:NYSE:T): AT&T is ranked 5th (out of 27) in its industry. Within the sector, AT&T is ranked 38th (out of 251).

- The HQC Scorecard confirms that AT&T is attractive regarding risk and reward. AT&T is rated as very attractive in Valuation and Expected Return categories. Furthermore, the company is rated as attractive in Financial Strength and Profitability categories. In the category of Economic Moat, AT&T gets a moderately attractive rating; however, in terms of Growth, the company is rated as unattractive.

- I rate AT&T as a buy: due to AT&T’s current valuation and the relatively low dividend payout ratio of just 51.95%, the risk of investing in AT&T is relatively low. However, due to the limited growth perspectives of the company’s business and the limited growth rates of its dividend, I would not overweight AT&T stock in an investment portfolio.

AT&T’s Competitive Advantages

AT&T’s strong brand image can be one of the company’s competitive advantages: according to Brand Finance, AT&T is ranked in position 26 on the list of the most valuable brands in the world. The company’s brand value is estimated to be about $47,009M.

As compared to its main U.S. competitors Verizon (NYSE:VZ) and T-Mobile (NASDAQ:TMUS), AT&T has the highest EBIT-Margin (21.24%); Verizon shows an EBIT-margin of 19.84% and T-Mobile of 13.33%. This indicates AT&T’s relatively strong competitive position compared to its main competitors, Verizon and T-Mobile.

However, with growth, T-Mobile is clearly ahead of AT&T: While AT&T has a Revenue Growth Rate of the last 5 Years [CAGR] of -0.67%, the same is 1.67% for Verizon and 15.3% for T-Mobile. When having a look at the Revenue Growth Rate of the last 3 Years [CAGR], the differences among them are even clearer: AT&T shows a Revenue Growth Rate of the last 3 Years [CAGR] of -5.15%, Verizon of 0.82% and T-Mobile of 21.92%, showing T-Mobile clearly is ahead in terms of growth.

Having a closer look at the EPS Diluted Growth Rate [FWD], we get a further indicator of AT&T’s weaker growth compared to Verizon and T-Mobile. While AT&T shows an EPS Diluted Growth Rate [FWD] of -7.52%, the same is 2.53% for Verizon and 34.21% for T-Mobile.

Overview: AT&T compared to its main competitors Verizon and T-Mobile:

AT&T | Verizon | T-Mobile | |

Sector | Communication Services | Communication Services | Communication Services |

Industry | Integrated Telecommunication Services | Integrated Telecommunication Services | Wireless Telecommunication Services |

Market Cap | 131.51B | 190.37B | 180.21B |

Employees | 172,400 | 118,400 | 75,000 |

Revenue [TTM] | 156.60B | 134.33B | 80.23B |

Operating Income | 33.26B | 26.65B | 10.69B |

Revenue 3 Year [CAGR] | -5.15% | 0.82% | 21.92% |

Revenue 5 Year [CAGR] | -0.67% | 1.67% | 15.30% |

Gross Profit Margin | 53.94% | 57.35% | 58.02% |

EBIT Margin | 21.24% | 19.84% | 13.33% |

Return on Equity | 11.27% | 26.24% | 2.50% |

Source: Seeking Alpha

AT&T’s Valuation

Discounted Cash Flow [DCF] Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of AT&T. The method calculates a fair value of $26.15 for the company. The current stock price is $18.73, which results in an upside of 39.60%.

The Average Revenue Growth [FWD] Rate of the last 5 years of AT&T is 0.35%. Therefore, I assume a Revenue and EBIT Growth Rate of 0% for the company over the next 5 years. Furthermore, I assume a Perpetual Growth Rate of 0%. I have used AT&T’s current discount rate [WACC] of 8% and the company’s Tax Rate of 20.3%. Furthermore, I used an EV/EBITDA Multiple of 5.6x for AT&T, the company’s latest twelve months EV/EBITDA.

Based on the above, I calculated these results:

Market Value vs. Intrinsic Value:

Market Value | $18.73 |

Upside | 39.60% |

Intrinsic Value | $26.15 |

Source: The Author

The fact that the current AT&T stock price shows an upside of 39.60% despite assuming a Revenue and EBIT Growth Rate and a Perpetual Growth Rate of 0% underlines my investment thesis that you could benefit from an AT&T investment despite the stagnation of AT&T’s business prospects.

Relative Valuation Models

AT&T’s P/E [FWD] Ratio

AT&T’s P/E Ratio is 7.82, which is 58.21% below the sector median (18.70). This provides us with a strong indicator that the company is undervalued. At the same time, AT&T’s current P/E Ratio is 38.26% below the company’s average P/E Ratio of the last 5 years (12.66), which is an additional indicator that AT&T is undervalued.

AT&T’s 24M and 60M Beta

Considering AT&T’s 24M Beta of 0.37 and 60M Beta of 0.69, we can see that an investment in AT&T can contribute to the risk reduction of your investment portfolio.

Dividend Projections for AT&T

Projection of AT&T’s Yield on Cost When Assuming Average Dividend Growth Rates of 0%, 1% or 2% per Year

In the graphics below, you can see different scenarios on how you would benefit from AT&T’s dividend when having a long-term investment horizon: you can see the results of AT&T’s yield on cost when assuming different dividend growth rates and assuming that you would invest in AT&T at the current stock price of $18.73. The yield on cost is a measure of dividend yield calculated by dividing a stock’s current dividend by the price that was initially paid for that stock.

I have made projections of an average dividend growth rate of 0%, 1% and 2% per year for AT&T. I expect the company to grow its dividend in these ranges in the upcoming years. The company’s 5 Year Average EPS Diluted Growth Rate [FWD] of 1.37% indicate that these ranges seem realistic.

When assuming a dividend growth rate of 1% per year on average for AT&T, you could expect a yield on cost of 6.61% in 2032, 7.30% in 2042 and 8.06% in 2052.

If a dividend growth rate of 2% is assumed, you would have a yield on cost of 7.29% in 2032, 8.89% in 2042 and 10.83% in 2052.

Year | Yield on Cost when assuming an Average Dividend Growth Rate of 0% Per Year | Yield on Cost when assuming an Average Dividend Growth Rate of 1% Per Year | Yield on Cost when assuming an Average Dividend Growth Rate of 2% Per Year |

2022 | 5.98% | 5.98% | 5.98% |

2032 | 5.98% | 6.61% | 7.29% |

2042 | 5.98% | 7.30% | 8.89% |

2052 | 5.98% | 8.06% | 10.83% |

Source: The Author

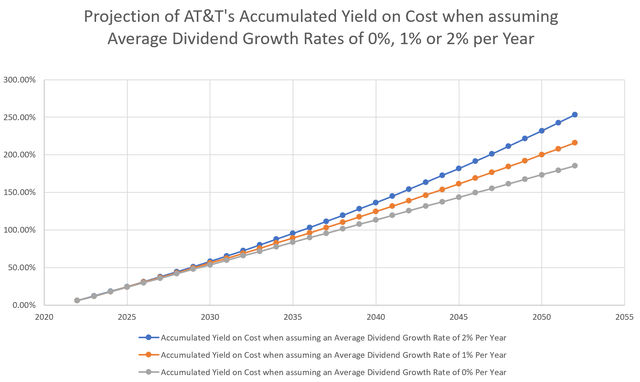

Projection of AT&T’s Accumulated Yield on Cost When Assuming Average Dividend Growth Rates of 0%, 1% or 2% per Year

In the graphic below, you can see that you could generate a relatively high accumulated yield on cost when aiming to invest in AT&T with a long-term investment horizon.

When assuming an average dividend growth rate of 0% per year for AT&T, you would have received 185.37% of your initial investment by dividend payments after 30 years. When assuming an average dividend growth rate of 1%, you would have received 216.06% of your initial investment in the form of dividend payments after 30 years. If an average dividend growth rate of 2% per year were assumed for AT&T, you would have received 253.42% of your initial investment by dividend payments by 2052 (no withholding taxes considered in these calculations).

The graphic shows us you would have received all your initial investment in the form of dividends by the latest in 2038, even if no dividend increases would be assumed (again, no withholding taxes are considered in this calculation). Due to AT&T’s relatively low dividend payout ratio of 51.95%, I expect no dividend cut in the near future.

Year | Accumulated Yield on Cost when assuming an Average Dividend Growth Rate of 0% Per Year | Accumulated Yield on Cost when assuming an Average Dividend Growth Rate of 1% Per Year | Accumulated Yield on Cost when assuming an Average Dividend Growth Rate of 2% Per Year |

2022 | 5.98% | 5.98% | 5.98% |

2032 | 65.78% | 69.17% | 72.77% |

2042 | 125.57% | 138.96% | 154.18% |

2052 | 185.37% | 216.06% | 253.42% |

Source: The Author

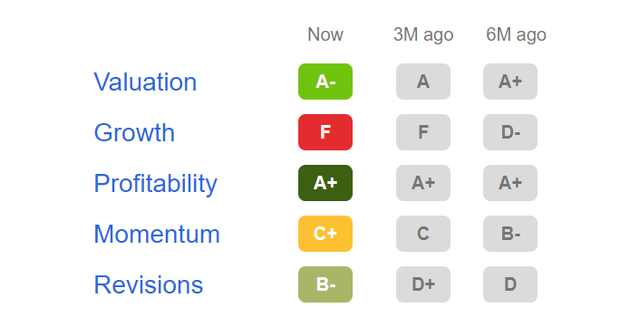

AT&T According to the Seeking Alpha Factor Grades

According to Seeking Alpha’s Factor Grades, AT&T is rated with an A- in terms of Valuation. For Growth, the company gets an F rating. In terms of Profitability, AT&T is rated with an A+.

AT&T’s relatively attractive rating according to the Seeking Alpha Factor Grades strengthens my belief that AT&T could be a good investment opportunity despite the stagnation of the company’s business.

AT&T According to the Seeking Alpha Quant Ranking

Considering the Seeking Alpha Quant Ranking, AT&T is ranked 5th (out of 27) within the industry and 38th (out of 251) within the sector.

The Seeking Alpha Quant Ranking reinforces the theory that AT&T is attractive compared to its competitors.

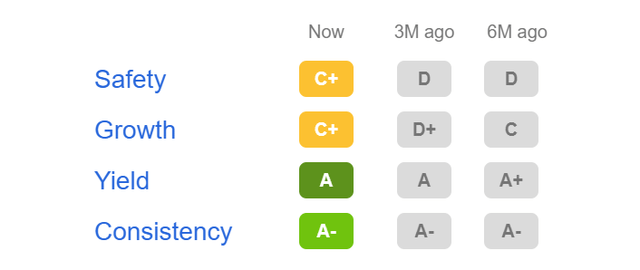

Seeking Alpha’s Dividend Grades

According to the Seeking Alpha Dividend Grades, AT&T is rated with an A in terms of Dividend Yield and an A- in terms of Dividend Consistency.

AT&T’s excellent rating in terms of Dividend Yield and Dividend Consistency are indicators that strengthen my belief that AT&T is a good investment choice for investors seeking dividend income.

The High-Quality Company [HQC] Scorecard

“The aim of the HQC Scorecard is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description about how the HQC Scorecard works.

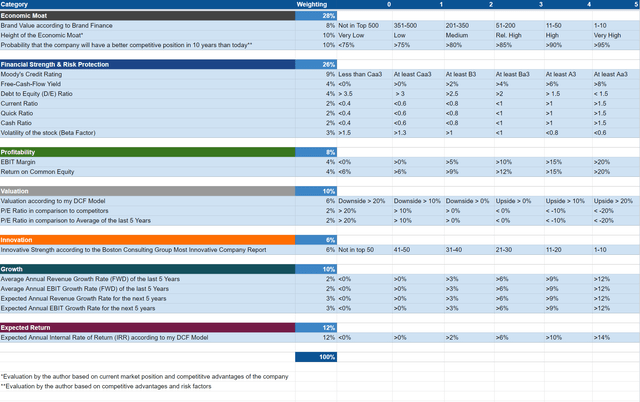

Overview of the Items on the HQC Scorecard

“In the graphic below you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every item that is rated.”

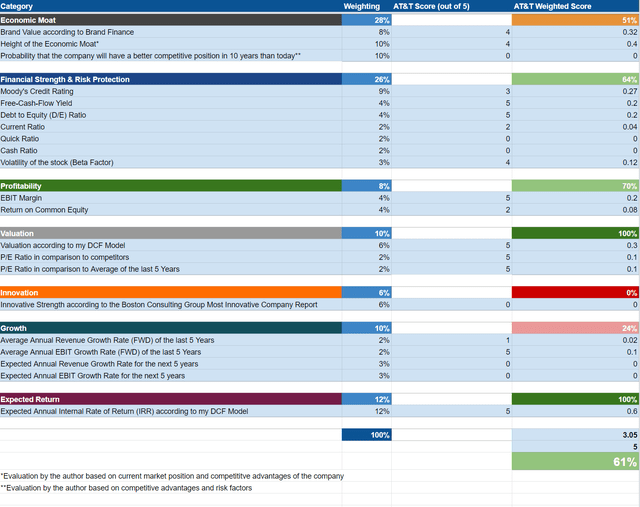

AT&T According to the HQC Scorecard

According to the HQC Scorecard, the overall score of AT&T is 61 out of 100 points. This means that AT&T can be classified as an attractive long-term investment in terms of risk and reward.

The HQC Scorecard indicates that AT&T is rated as very attractive in the Valuation and Expected Return categories. Furthermore, AT&T is rated as attractive in the Financial Strength and Profitability categories. In the category of Economic Moat, AT&T gets a moderately attractive rating. In terms of Growth, AT&T is rated as unattractive.

The attractive overall scoring for AT&T according to the HQC Scorecard strengthens my belief that AT&T can be considered an appealing long-term investment despite experiencing stagnation in its business.

Risks Factors

One of the main risks for AT&T is the competition with its opponents, Verizon and T-Mobile. Comparing AT&T’s 5 Year Average Revenue Growth Rate [CAGR] of -0.67 with that of T-Mobile (15.30%) indicates that the company is losing market share within its business segment.

Stagnation or even a decline in revenue represents one risk of an investment in AT&T. However, when calculating the fair value of the company, according to my DCF model, I have made conservative assumptions and, therefore, assumed a Revenue and EBIT Growth Rate and a Perpetual Growth Rate of 0% for AT&T. In this calculation, I showed that even when assuming a stagnation of AT&T’s business, there is still an upside potential of 39.60%.

I see another risk factor for AT&T in that its dividend could be cut. If this happens, it could adversely affect the stock price of AT&T. However, due to the current company’s payout ratio of just 51.95%, I do not expect this to occur in the near future. Therefore, I believe the risk of investing in AT&T is relatively low.

The Bottom Line

As shown in this analysis, companies with stagnant business prospects can still be attractive investment opportunities when valued at a fair price. This is the case for AT&T, in my opinion.

AT&T can be a good choice for your investment portfolio, especially when looking for a dividend income stock that contributes to the risk reduction of your portfolio. However, take into account that the dividend growth perspectives of AT&T are limited. I expect AT&T to grow its dividend by 1-2% per year on average over the long term.

AT&T’s strong ranking, according to the Seeking Alpha Quant Ranking, underlines the company’s competitive position: AT&T is ranked 5th (out of 27) within its industry and 38th out of 251 within the sector. According to Seeking Alpha’s Factor Grades, AT&T is rated with an A- in terms of Valuation, confirming the attractive valuation of AT&T. In terms of Profitability, AT&T is rated with an A+, another indicator of AT&T’s strong market position.

Furthermore, the HQC Scorecard results show that AT&T is attractive in terms of risk and reward. The company scores 61 out of 100 points according to the HQC Scorecard. AT&T shows strong results in the categories of Valuation and Expected Return. In the categories of Financial Strength and Profitability, the company is rated as attractive.

However, due to the limited growth prospects of AT&T and a limited dividend growth rate, I recommend you not to overweight the AT&T position in an investment portfolio.

Author’s Note:

Thank you very much for reading! If you have any questions regarding this analysis, feel free to leave a comment below!